Businesses across the UK are facing a financial storm in 2025. The rise in the National Living Wage, higher statutory payments, and an increase in National Insurance Contributions (NICs) are all set to squeeze employer budgets. With NICs rising from 13.8% to 15% and the lower threshold dropping from £9,100 to £5,000, the financial burden is undeniable.

A recent survey of 2,000 UK businesses revealed that 1 in 4 companies have no plan in place to deal with these rising costs. Even more concerning, 43% of respondents admitted they’re unsure how to ensure continued business growth. The message is clear: businesses need to act now to protect their profitability and workforce.

In this blog, we’ll break down the true cost of these changes, explore real world examples and provide practical strategies that businesses are using to weather the storm.

The Reality Check: Unprepared and Worried

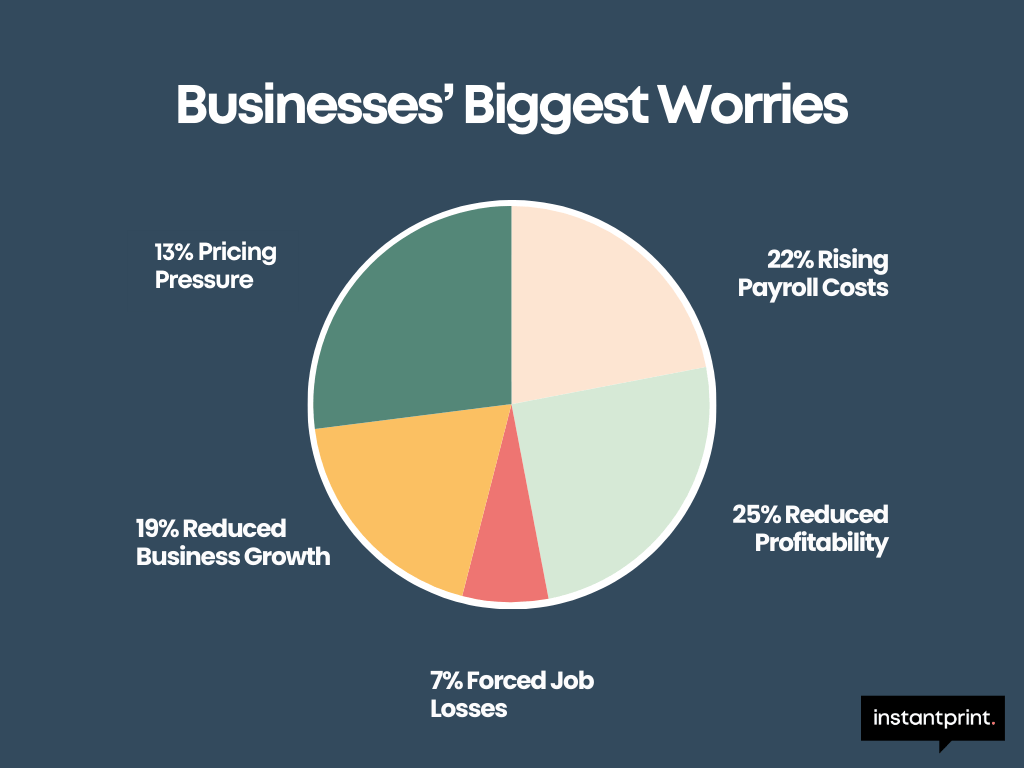

The numbers don’t lie – businesses are struggling to come to terms with what’s ahead. Our survey revealed the biggest concerns for business owners:

- Rising payroll costs (22%)

The National Living Wage is increasing from £10.42 to £11.44 per hour. For a full time employee working 37.5 hours per week, that’s an annual increase of £1,872 per employee. Multiply that across a workforce and the numbers become significant. - Reduced profitability (25%)

Higher payroll costs, increased NICs, and rising statutory payments mean slimmer profit margins. Many businesses report needing to cut expenses or find new revenue streams. - Forced job losses (7%)

Some businesses fear they will have to make redundancies or reduce staff hours to offset the higher wage bill. - Reduced business growth (19%)

Many business owners have reported they’re halting expansion plans due to financial uncertainty. - Pricing pressure (27%)

With costs increasing, many businesses are feeling the pressure to raise prices, but worry about losing customers as a result.

One business owner summed it up: “We’ve already been cutting costs where we can, but with wages and NICs going up, we’re running out of options.”

Industries with a high percentage of minimum wage workers – such as hospitality, retail and manufacturing are particularly vulnerable.

The Immediate Impact: Payroll, Statutory Payments & Employer NICs

What does this mean in real terms?

For an average small business with 10 employees on minimum wage, the cost increase breaks down like this:

Wage increases:

With an hourly wage of £12.21 (New NMW) and 37.5 hours per week, employees' gross income is moving to £23,809.50 per year.

This means each employee receiving NMW earns an additional £1,872 per year VS the last financial year.

Total additional cost for 10 employees on minimum wage: £18,720 per year.

Employer NICs:

With the NIC rate rising to 15% and the lower threshold dropping to £5,000, businesses will pay significantly more.

For businesses paying £12.21 per hour (the new national minimum wage), NICs alone will increase by £790.36 per year.

Total additional EmployerNICs cost for 10 employees on minimum wage: £7,903.60 per year.

Statutory payments:

Increases in sick pay, maternity, and paternity pay add further financial strain, especially for SMEs.

What's increasing?:

- Statutory sick pay: From £116.75 to £118.75 per week

- Statutory maternity pay: From £184.03 to £187.18 per week

- Statutory adoption pay: From £184.03 to £187.18 per week

- Statutory shared parental pay: From £184.03 to £187.18 per week

- Statutory paternity pay: From £184.03 to £187.18 per week

- Statutory parental bereavement pay: From £184.03 to £187.18 per week

- Lower earnings limit: From £123 to £125 per week

To calculate exactly how much these increases will cost your business, try the Zelt NIC calculator and the salary calculator. The above calculations have been made using these tools.

The Big Question: How Are Businesses Coping?

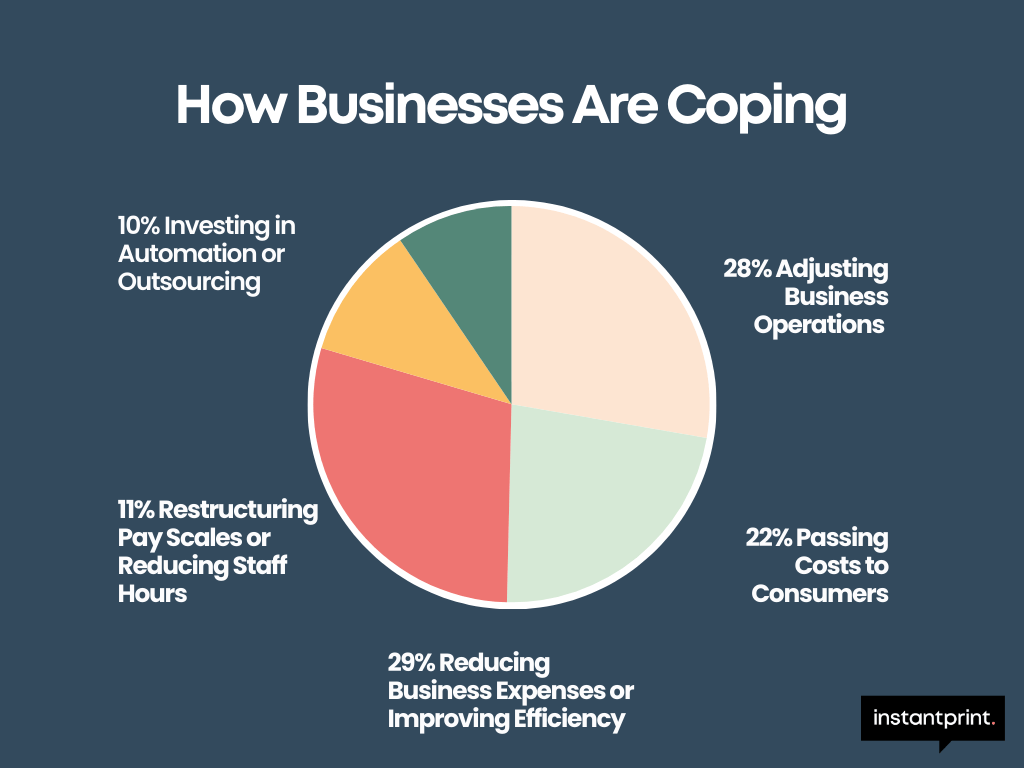

Faced with these mounting costs, businesses are adopting different survival strategies:

- Adjusting business operations (38%) – Streamlining processes, outsourcing non-core activities and reducing operational waste.

- Passing costs to consumers (31%) – Raising prices while maintaining value perception to avoid losing customers.

- Reducing business expenses or improving efficiency (40%) – Cutting unnecessary expenses and renegotiating B2B supplier contracts.

- Restructuring pay scales or reducing staff hours (15%) – Adjusting compensation structures to remain competitive.

- Investing in automation or outsourcing (13%) – Using AI and technology to automate repetitive tasks.

Businesses are making tough choices to stay afloat, from streamlining operations to investing in automation. However, adapting to these changes isn’t always easy. As one respondent shared, “We’re investing in automation to reduce payroll costs, but it’s a tough transition.” The challenge lies in balancing innovation with sustainability, those who can navigate this shift effectively will be better positioned for long term success.

The Recruitment and Retention Challenge

These cost increases don’t just affect numbers – they impact people. 44% of businesses believe that rising costs will have a negative impact on employee satisfaction and retention.

Some businesses have shared with us how they’re thinking outside the box to retain talent:

- Flexible working arrangements to help reduce commuting costs and boost employee morale.

- Performance based incentives instead of flat pay increases. This ensures that pay is distributed in a sustainable way.

- Upskilling opportunities to increase job satisfaction and productivity. Listening to employees' career goals and offering internal mentorship programmes to retain top talent.

Do you have any outside the box methods towards adding value to your workforce that aren’t mentioned? Let us know on social media by tagging us @instantprintuk in your response!

Planning for the Future: What Businesses Are Doing Now

With April 2025 on the horizon, businesses across all industries are already taking proactive steps to stay ahead. Rather than seeing rising costs as a roadblock, many are using this as a chance to rethink their strategies, boost efficiency and futureproof their operations.

We asked businesses how they’re adapting and what steps they’re taking to offset rising employer costs. Their responses were full of smart, forward thinking ideas here are our top five picks:

1) Prioritising Efficiency Across Operations

"We are ensuring that every aspect of our business operates with maximum efficiency, from the creative process to final delivery. By maintaining a strong focus on productivity and streamlining workflows, we can continue delivering high-quality work while keeping costs under control." - Creative, Arts & Design Business, West Midlands

2) Smarter Working Practices to Reduce Costs

"We’re adopting a smarter approach to meetings by replacing unnecessary travel with virtual calls via Zoom or phone. When in person meetings are required, we’re scheduling them strategically such as starting later in the day to allow staff to take advantage of off-peak travel fares helping us cut costs without compromising on collaboration." - Sales Business, East of England

3) Leveraging Technology for Seamless Operations

"By integrating automation into our business, we’re reducing administrative overhead and improving efficiency. Automated scheduling, invoicing, and customer management tools enable us to save time, minimise errors, and focus on delivering exceptional service to our clients." - Personal Services Business, London

4) Optimising Costs Through Supplier Choices & Pricing Adjustments

"To navigate rising costs, we’re focusing on three key areas: streamlining our operations, adjusting our pricing strategy, and sourcing materials from more cost-effective suppliers. This approach ensures we maintain profitability while continuing to offer value to our customers." - Creative, Arts & Design Business, London

5) Maximising Productivity Through Automation & Process Optimisation

"We’re investing in efficiency improvements by automating key processes and optimising workflows. By reducing manual labour costs and increasing overall productivity, we’re ensuring our business remains competitive in a challenging economic climate." - Construction, Utilities & Contracting Business, London

Download Your Free Futureproofing Checklist

Futureproofing your business doesn’t have to be overwhelming. Our free checklist, inspired by what businesses are already doing, breaks it down into simple, actionable steps to help you strengthen operations, cut costs and stay competitive.

✔️ Conduct a Workforce Audit – Identify inefficiencies in staffing and processes. Assess whether automation or AI tools could improve productivity.

✔️ Review Your Financial Position – Forecast payroll and NIC costs. Consider Salary Sacrifice Schemes. Identify ways to reduce unnecessary expenses or increase revenue streams.

✔️ Adjust Pricing Strategies – Evaluate competitor pricing and adjust yours strategically to maintain profitability without losing customers.

✔️ Improve Operational Efficiency – Use AI-driven tools to automate admin tasks. Reduce waste and streamline processes to boost efficiency.

✔️ Communicate with Employees – Keep staff informed about changes and gather their input on efficiency improvements. Offer flexible work or training as alternative benefits.

✔️ Seek Professional Advice – Consult with accountants and HR specialists. Explore tax reliefs and government support schemes.

Looking Ahead: Turning Challenges into Opportunities

While the rising costs of 2025 present undeniable challenges, businesses that take proactive steps now will be best positioned for success. By prioritising efficiency, investing in smart solutions and adapting to new financial realities, companies can not only weather the storm but emerge stronger.

This period of change offers an opportunity to reassess strategies, embrace innovation and build a more resilient business model. Whether it’s through automation, smarter cost management, or a renewed focus on employee satisfaction, there are plenty of ways to stay ahead.

The key takeaway? The businesses that plan, adapt and innovate will be the ones that thrive. Now is the time to take action, futureproof your operations and turn these challenges into opportunities for growth.

.png)